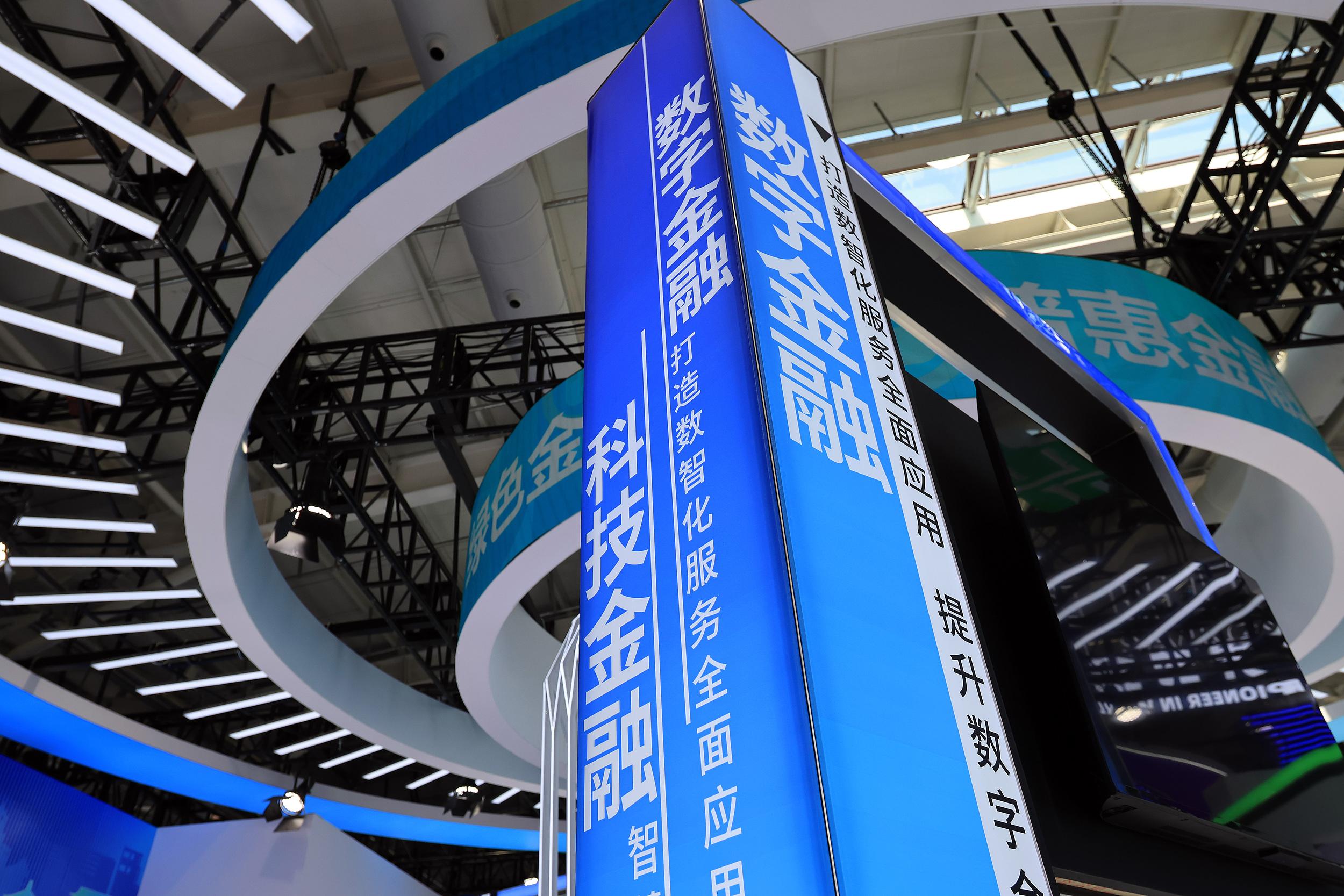

Extensive Plan for Digital Finance Growth

The People's Bank of China and six other governmental departments have jointly released an action plan aimed at promoting the high-quality development of digital finance by 2027. The announcement, made on November 27, outlines a framework to establish a financial system that is highly compatible with the growth of the digital economy.

The plan highlights the crucial role of data elements and digital technologies as driving forces in accelerating the digital transformation of financial institutions. It aims to solidify the foundations of digital finance and enhance its governance structure.

Financial institutions are encouraged to leverage digital technologies to improve the efficiency of their services, thus facilitating the high-quality development of China's digital economy.

To effectively implement the digital transformation of financial institutions, the plan suggests strengthening digital technology support capabilities. This includes the establishment of a digital public service platform for the securities and futures industry, which will provide necessary data and technical resources for financial institutions.

Expansion of the application of digital technologies across various sectors, including technology finance, green finance, inclusive finance, pension finance, and the integration of digital and real economies, is also on the cards.

Regarding the integration between digital and real economies, the plan calls for accelerating innovation in digital finance, leveraging the role of re-lending for scientific and technological innovation and technical renovation, and guiding financial institutions to integrate financial services into digital scenarios such as the industrial internet and "AI + Industry."

The establishment of cross-border digital financial platforms to facilitate the digitalization of shipping and trade is also encouraged.

In addition, the plan mentions the necessity to cement the foundation of digital finance by creating an efficient and secure payment environment and setting up a robust financial consumer protection mechanism.