By?LI?Linxu

In its latest moves to encourage enterprise innovation, China has extended and refined a series of preferential tax and fee policies.

Of particular note is that the country pledges to further improve its policy on the pretax deduction of R&D expenses of enterprises, according to a notice recently released by the Ministry of Finance (MOF) and the State Taxation Administration (STA).

Starting from January 1, 2023, if the actual R&D expenses of eligible enterprises haven't formed intangible assets and are included in the current profits and losses, an additional 100 percent of such R&D expenses will be granted for the pretax deduction.

If their actual R&D expenses have formed intangible assets, 200 percent of the cost of such intangible assets is entitled to be amortized before tax, according to the notice.

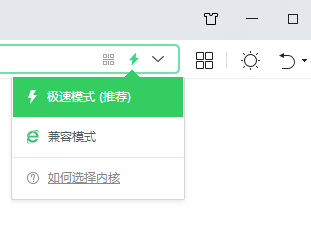

A staff member is operating the automation equipment in a hi-tech company's new materials R&D lab, Hangzhou, Zhejiang province. (PHOTO: XINHUA)

As an important inclusive policy in the systems of sci-tech innovation policies, pretax deduction of R&D expenses of enterprises has gained significant results, said Zhu Zhongming, vice minister of finance, adding that it has played a positive role in encouraging enterprises' spending on R&D.

The policy is a follow-up to this year's government work report, which vowed to improve preferential tax and fee policies, and extend and further refine policies on tax and fee cuts, tax rebates, and tax deferrals as the situation requires.

The additional pretax deduction of R&D expenses will become a long-term institutional arrangement, according to an executive meeting of the State Council held last month.

Experts believe that China's extension and implementation of a package of preferential tax and fee policies will further benefit market entities, boost market confidence, and bolster enterprises' spending on R&D.

Statistics show that, under the preferential tax policies to support sci-tech innovation, the amount of tax and fee cuts increased by 28.8 percent on average annually during 2018-2022.

These policies have been effective in stimulating enterprises' innovation momentum, said Luo Tianshu, chief accountant of STA, noting that during 2018-2022, the R&D spending from enterprises registered an average annual growth rate of 25.1 percent.

Large language model, "Huashan", specifically applied in the aerospace field for the first time, was launched at the 2024 China Satellite Application Conference.